annuity inheritance tax pennsylvania

All Major Categories Covered. Fisher Investments warns retirees about annuities.

Pennsylvania Inheritance Tax 39 Free Templates In Pdf Word Excel Download

Where to report the value of annuities for inheritance tax.

. Ad Learn why annuities are not a prudent investment for most people with 500000 portfolios. Section 2111d of the. Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

Section 2111 d of the Inheritance and Estate. Section 2111d of the. Under certain circumstances a annuity in a retirement account may be exempt from Pennsylvania Inheritance Tax as life insurance.

All proceeds of life insurance on the life of the. Ad Learn More about How Annuities Work from Fidelity. Are annuities taxable in Pennsylvania.

An annuity contained in a retirement account may be exempt from Pennsylvania Inheritance Tax as life insurance under certain circumstances. The rates for Pennsylvania inheritance tax are as follows. Ad Select Popular Legal Forms Packages of Any Category.

Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. If the annuities represent a return on an investment a single premium was paid they are taxable and should be reported. A retirement account characterized as an annuity that allows for regular payments to the annuitant and that does not involve any element of risk on the part of the provider is not.

An annuity contained in a retirement account may be exempt from Pennsylvania Inheritance Tax as life insurance under certain circumstances. People inheriting an annuity owe income tax on the difference between the principal paid into the annuity and the value of the annuity at the annuitants death. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying.

0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger. PA inheritance tax at 45 will also be paid on the Daughters receipt of the IRAs the 401k and the annuities. Ad Learn More about How Annuities Work from Fidelity.

If the decedent lived in one of these states at the. My father passed away and I was named the beneficiary for 50 of the value on 4 non-qualified annuities and 1 CAP IRA. How taxes are paid on an.

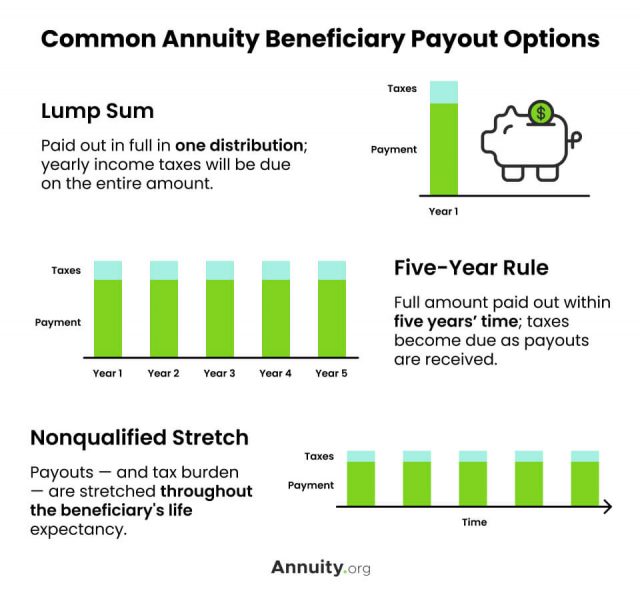

Do I have to pay PA inheritance tax on Annuity IRAs. Understanding how inherited annuities are taxed starts with knowing the difference between qualified and non-qualified annuities. How Inherited Annuities Are Taxed.

The general answer is yes the annuity is subject to the PA Inheritance Tax and the tax is calculated on the Fair Market Value of the contract on the date of death. 45 percent on transfers to direct. In the United States only six states -- Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania -- impose a tax on inheritances.

An annuity contained in a retirement account may be exempt from Pennsylvania Inheritance Tax as life insurance under certain circumstances.

7 Simple Ways To Minimize The Pennsylvania Inheritance Tax

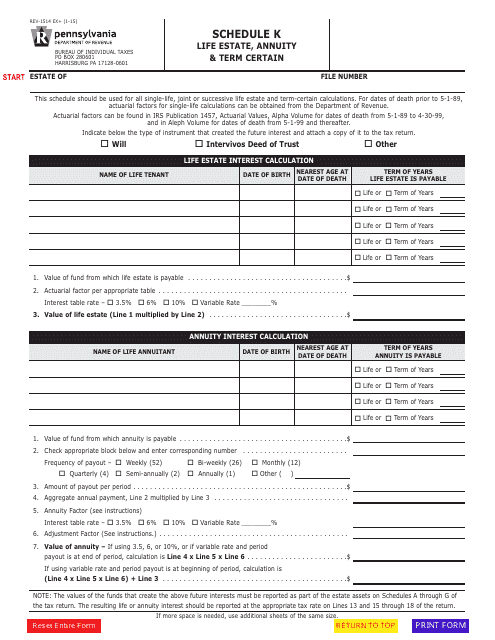

Form Rev 1514 Schedule K Download Fillable Pdf Or Fill Online Life Estate Annuity Term Certain Pennsylvania Templateroller

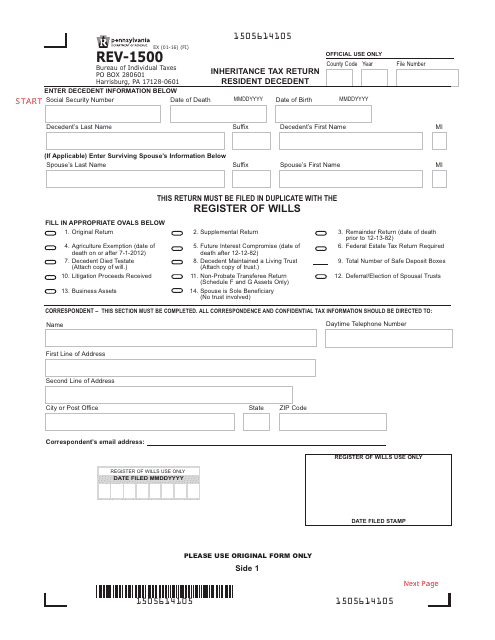

Form Rev 1500 Download Fillable Pdf Or Fill Online Inheritance Tax Return Resident Decedent Pennsylvania Templateroller

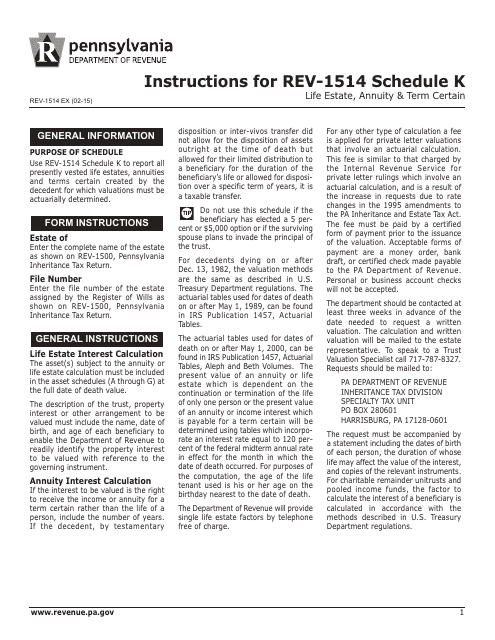

Download Instructions For Form Rev 1514 Schedule K Life Estate Annuity Term Certain Pdf Templateroller